For the best reading experience, read this newsletter online by clicking here!

If you’re reading this and not already a subscriber, then click on the button below and look forward to receiving these newsletters into your inbox every Monday.

Afternoon All,

I thought I’d try and keep everyone’s inboxes uncluttered on their bank holiday Monday, so The Argus Report is being sent out today. We’ll return to normality next week.

Anyway, without further ado, let’s get onto the news!

Stonks v2

If you’ve been keeping a keen eye on markets recently, you will have noticed the return of everyone’s favourite ‘meme stonks’. Shares in GameStop, AMC, Nokia, Blackberry and many more have been ripping as a result of huge volumes of retail money being poured into the companies that r/WallStreetBets know and love so much1.

We spoke about the first time this happened at great length at the beginning of the year, so if you want a reminder of what occurred, go and have a gander at my ramblings that I penned at the time.

Apart from the hilarities involved in pumping stocks up for no reason whatsoever, the interesting part of this resurgence is that it seems the title of ‘head stonk’ has been handed from GameStop to the teetering cinema operator AMC2.

AMC started being the talk of the town around this time last week and the retail crowd have really gone all-in on the stock. Here’s what its share price has done over the last 6 months:

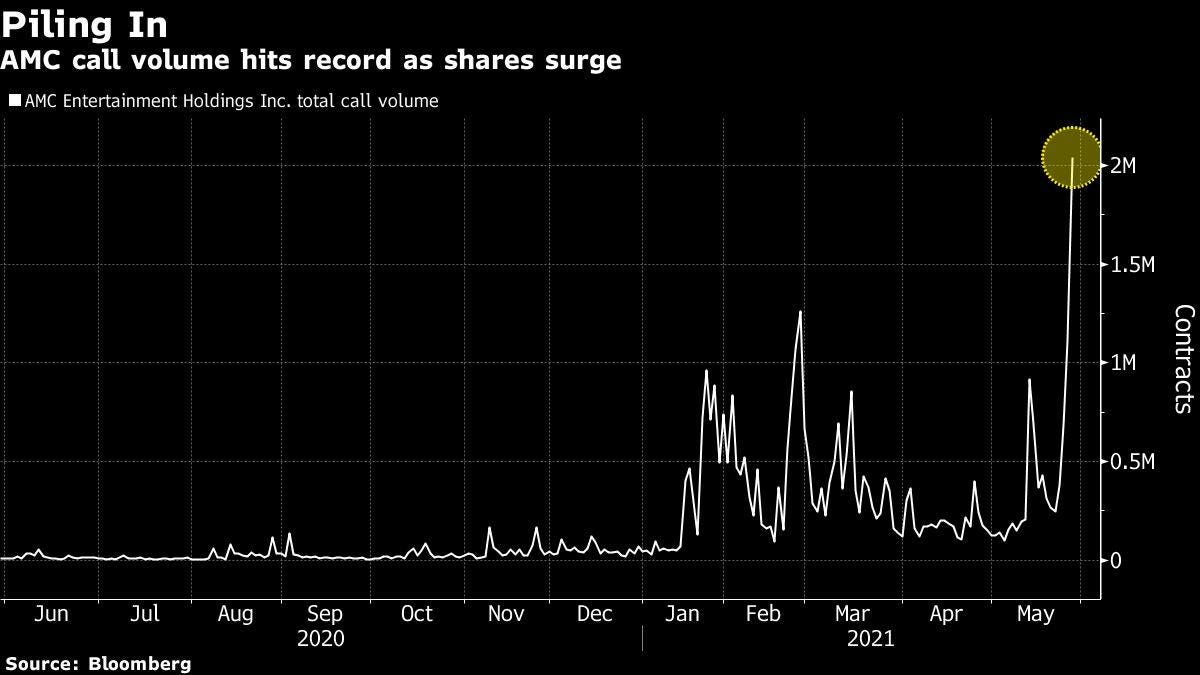

And here are the call option volumes to support this rise:

Nuts.

But hang on. This is 2021. We’re used to seeing meaningless movements in companies that should be worth a fraction of their current market cap. Why is this being given an entire section to itself this week?

Well, we got a press release this morning from AMC’s management who announced that they had just raised $230m from a fresh sale of equity to Mudrick Capital3. In case you’re confused at this point, this is the same Mudrick Capital that provided the rescue financing for AMC at the beginning of the year and then subsequently converted all of their convertible debt into equity at the peak of the first bubble and making a tidy $100m of ‘tendies’ in the process.

This trade looks so weird from where I’m sitting, as it doesn’t make much sense at all. AMC is thought to have reached the peak of its second wave over the weekend, and Mudrick Capital wants to BUY shares at this level… The timing just seems really off.

Possible reasons behind the trade could be that Mudrick is covering a massive short position that it had built up in the aftermath of the first wave, and it simply wants to cut its losses. This tactic has been used before but is highly frowned upon, as the equity raise dilutes the rest of the shareholder base and usually makes the shares less valuable.

Another possible reason is that Mudrick could be using this equity as a hedge for a massive short bet that it has against AMC’s debt. Whilst unlikely, it would make sense, as if the stock continues to go to the moon, they can reap the upside in the equity appreciating, whilst they get slaughtered by the price of the bonds also increasing.

Although it’s probably too early to tell what’s actually happened here, there are already a couple of headlines that suggest that Mudrick’s shares have already been sold off, leading to the potential conclusion that they were just looking to make a quick buck off the retail hype. They probably entered the trade assuming that the retail crowd would see the equity raise as good news, rather than the bad news that it actually is.

I’m sure there will be more on this story throughout the rest of the week, so I will update you in our next edition.

Streaming

This past year has been a great one for M&A around the world.

With equity markets reaching all-time highs and debt continuing to be as cheap as chips, deal flow and valuations have reached (I hate to say it) unprecedented levels.

This is why the following headline really wasn’t surprising in the slightest.

Whilst this valuation seems like it’s a little bit on the top end — considering the studio’s only real assets are the rights to the James Bond and Rocky films — the rational kind of makes sense from Amazon’s perspective.

Amazon Prime Video is rapidly losing market share to the likes of Netflix, Disney+ and HBO Max, and they’re in dire need of new, exclusive content4. Bringing the Bond franchise onto their platform creates a unique opportunity for Amazon to flex their own exclusive content in the faces of competitors and start reclaiming the market share that was once theirs.

Whilst the price remains questionable, Amazon’s own share price is sky high, and it’s currently sitting on $42bn of cash at the end of 2020, so I don’t think they’ll be breaking a sweat. This financial flexibility allowed it to allegedly offer $3bn more than the nearest bidder for MGM, which is a bit of a statement in itself.

One interesting detail in amongst all of this is that the seller in this transaction was a group of distressed hedge funds led by Anchorage Capital. The current ownership situation of MGM stemmed from its 2005 LBO by Sony, Providence Equity Partners and TPG, which saddled the studio with so much debt that it had to be restructured in the aftermath of the financial crisis.

Creditors then ran the company in the subsequent decade, and the Amazon deal marked their exit from the trade. It’s rumoured that a number of the distressed hedge funds holding MGM’s equity cleared over $1bn of profit, which is fun for them, I guess…

RaaS

RaaS, or ransomware-as-a-service5 is something that I had no idea existed up until the news of the Colonial Pipeline hacking started emerging a couple of weeks ago.

For some context, on the 12th of May, a group of hackers penetrated the systems that managed the second-largest oil pipeline in the US, stopped everything, and demanded that the company pay a ransom. The attack shut down 15% of the US’s flow of oil for a couple of days before the company finally succumbed and paid the ransom and everything was returned to usual. The hack was allegedly carried out by a team in eastern Europe, that were using software provided to them by a company called DarkSide.

DarkSide is a company that creates packages that allow hackers to easily penetrate companies cyber defences, extract data, hold that data hostage, then demand that the crippled company pay a ransom. This business model is called ‘ransomware-as-a-service’ and allows the hacker teams to keep a large % of the total ransom whilst DarkSide will keep a small slice for themselves. This means that DarkSide technically stays out of reach from authorities as they aren’t the ones doing the actual hacking. To put this arrangement in other term, it would be like if a company created a delivery app for drug dealers. Whilst the company wouldn’t be selling the drugs themselves, they’re just streamlining the process and taking their cut.

The attack on the Colonial pipeline went too far, however, and DarkSide’s PR team (which is a hilarious concept in itself) issued the following statement:

“We are apolitical, we do not participate in geopolitics, do not need to tie us with a defined gover[n]ment and look for other our motives.

Our goal is to make money, and not creating problems for society.

From today we introduce moderation and check each company that our partners want to encrypt to avoid social consequences in the future.”

So, to round up this story, DarkSide, a company whose entire business model is centred around helping hackers criminally extort money from companies who’ve had their data stolen, will now prevent their users from inflicting any harm on companies that have a ‘social impact’. Excellent. Just excellent.

Anyway, I’ll leave you with this guide on how you can get a job at a hacker group like DarkSide. Let me know if any of you get through to the interview stage.

That’s it for today, so let’s get onto the other stuff.

Read This:

This is an excellent piece from back in 1993 about one man’s email relationship with Bill Gates. It’s a fascinating read and well worth a look if you have a spare half hour this week. Click here to take you to the website.

Subscribe To This:

A couple of you got in contact with me after my newsletter recommendation last week to ask what other newsletter’s I’d recommend, so, in this week’s edition of promoting my competitors, I present to you Chris Haffenden ‘Friday Workout’. Chris spent his entire career covering distressed and high yield markets before moving into journalism, and I think his thoughts and opinions are well worth listening to. Check out and subscribe to the 9fin blog here.

Here Are A Few Interesting Fíñançé Articles for You to Casually Peruse:

Chamath’s Fund’s Annual Report Was Full Of Porky Pies (Twitter Thread)

National Oil Firms Emerge The Winners From Shells Recent Ruling (Reuters)

Wall Street’s Love Affair With China, And What It Means (FT)

The Lie That Amazon Loves To Pedal About Prime (Matt Stoller)

Looking At The Concept Of Upside Decay (Brian Lui)

Here Are Some Other Things That I Enjoyed Reading This Week:

Crypto Farm Discovered After Police Mistook It For A Weed Farm (CNBC)

A £20m Rolls Royce That Resembles A Yacht (Speedhunters)

Drifting At Fuji Speedway (Speedhunters)

Content Corner:

Looking at reader analytics, I’m getting the vibe that I should turn The Argus Report into a newsletter that just looks at cute photos of animals doing funny things. You lot just can’t get enough of it. Anyway, here’s an outstanding video of a dog and a calf being best friends. Enjoy!

Well done for making it through all of that, and, as always, feel free to reach out if you fancy. Also, please feel free to share/forward this email far and wide, as the more the merrier!

On that note, stay safe, stay alert, and have a great week everyone!

AC

In case you’re wondering, the retail folk are using exactly the same strategies that they used last time they chose to pump these meme stonks. They’re buying large volumes of out-of-the-money call options, as, for reasons I don’t want to get into, this forces the broker-dealers to buy the underlying shares at whatever price they trade at. Due to the amount of call option volume that retail is pushing through the market, dealers have been chaotically buying the underlying shares, which has caused the meme stonks to rocket. Flows over fundamentals am I right?!

AMC runs nearly 1,000 theatres around the world. The firm spent the majority of last year on the brink of declaring bankruptcy but was rescued by a last-minute financing round led by SilverLake and Mudrick Capital at the end of 2020 and in the weeks leading up to ‘first wave’.

Here’s the press release, and here’s a great breakdown of the announcement by Alphaville’s Jamie Powell.

Lucky for you, readers of The Argus Report get free content delivered into your inbox each week for free! As a ‘well done’ for making it all the way down here into the footnotes, here’s another video that just didn’t make the cut for Content Corner this week.

On a side note, this whole ‘X-as-a-service’ thing is getting a bit out of hand. I saw an article on a start-up that was offering ‘banking-as-a-service’ the other day, which really took me a second to process. I concluded that banking was already ‘a service’ and that this startup was really just trying to be another Monzo, and wanted an excuse to use a word that sounded revolutionary. Cool.