For the best reading experience, read this newsletter online by clicking here!

If you’re reading this and not already a subscriber, then click on the button below and look forward to receiving these newsletters into your inbox every Monday!

Afternoon All,

Before we begin, I just want to say another huge thank-you to everyone that is continuing to share The Argus Report with your families, friends, and colleagues each week. Seeing subscriber numbers tick up every day is incredibly motivating, so just know that your efforts are being appreciated.

Enough soppiness, onto the news.

Huarong

This is quite a niche, nerdy section, so bear with me, as this stuff is important1.

Before we get into the specifics around Huarong Asset Management, everyone needs to understand that China’s banking system is messy.

As the Chinese have been through so many booms and busts over the last few decades, there are a lot of ‘bad loans’ on the bank’s balance sheets (i.e. a lot of companies and people have defaulted on their loans, mortgages and bills). As China is China, and most of the banks2 are SOE’s (state-owned enterprises), they are in the unique situation of being able to effectively manage these ‘bad loans’ (know as non-performing loans or NPLs) so that they won’t inhibit the bank’s ability to lend to the Chinese population. This makes banks more efficient and keeps the cost of debt low for the rest of the population.

The way that China decides to manage their NPL problem is by packaging all of their bad loans up, and removing them from the balance sheets of the big banks, by selling them to specialised ‘asset managers’ or ‘bad banks’. These ‘bad banks’ sole purpose is to try and work with the debtors that have defaulted and attempt to extract as much value from them as possible. This could be directly working with the individuals involved and help them return to a point where they can pay off their debts in full, or seizing the underlying collateral that their loan is secured against.

This process exists around the world, but China is differentiated in the sense that the flow of NPLs to their bad banks is continuous, and is extremely proactive. The ‘bad banks’ exist to ensure that the ‘NPE Ratio’ (‘non-performing exposure’) of all of the big banks remains low, year after year. It’s quite smart.

This brings us back to Huarong Asset Management, a bad bank initially set up in 1999 to warehouse over $50bn worth of NPLs from ICBC, one of the ‘big four’ banks. The concept was clearly proven successful (and managed to impress those at the top of the communist party) as, in the 22 years since its inception, Huarong’s assets have been allowed to sky-rocket to ~1.7 trillion renminbi (~$266bn/~£191bn)3.

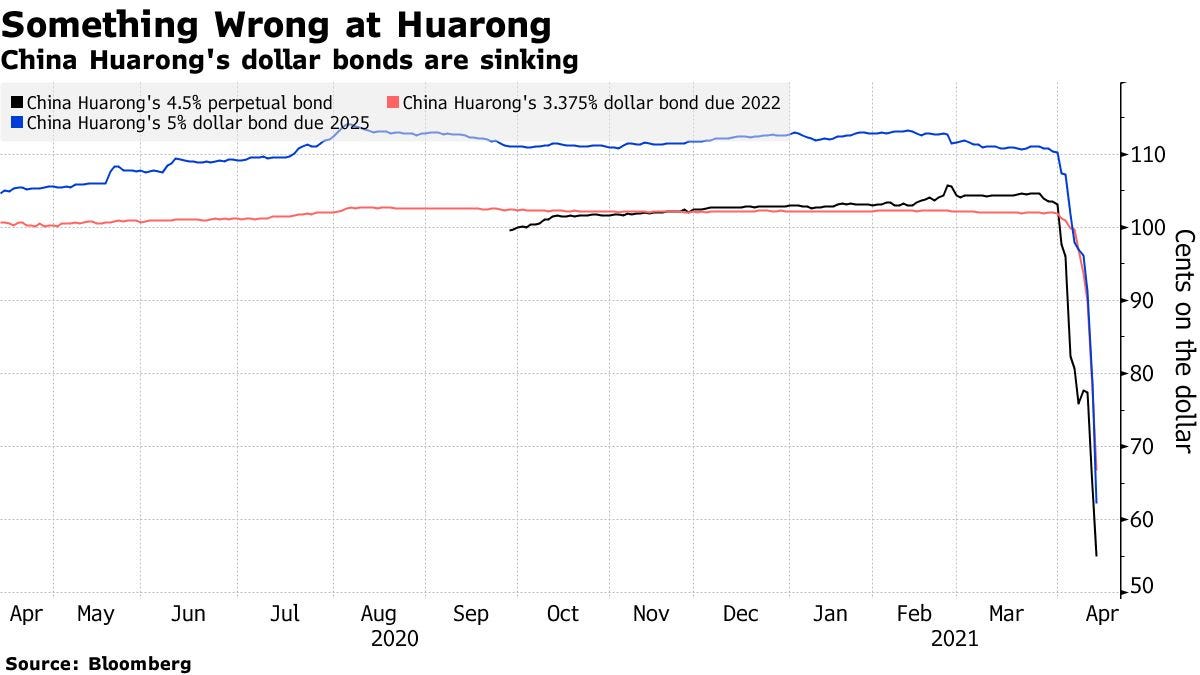

The reason we’re talking about Huarong is because of a rumour that began circulating last week that the state-backed asset manager was on the verge of bankruptcy, as it wasn’t able to pay back the principal on one of its dollar bonds, and that the Communist Party wasn’t going to step in and bail it out. This was on the back of it also postponing its annual results announcement date, which all together painted a very scary picture for investors. Naturally, shares were halted, but the bonds continued trading4, and the selloff was spectacular.

This rumour shot fear into everyone involved in Chinese fixed income markets, as the entire finance community has spent the last 20 years operating under the assumption that China will always act as a financial backstop to its largest SOE’s, and the prospect of them not being there puts a lot of things into question.

In classic Chinese fashion, however, this episode was concluded by China’s banking regulator issuing a statement on Friday that Huarong had ‘ample liquidity’ (we’ve heard that before: @dickfuld), and that their maturity payment had been wired to the administrative agent, ready to be paid to creditors. In other words:

Panic over.

To those out there that are interested in the Chinese debt landscape (my guess is there are about 3 of you), I cannot recommend highly enough the papers that Ben Fanger and the rest of the ShoreVest team put out now and then. Ben’s shop is one of the few brave enough to venture into the treacherous world of distressed debt on the Chinese mainland, and his insights are some of the best. Click here to go to the ShoreVest website and read some of what it has to say.

Toshiba: Round #2

Some of you out there will remember that we spoke about Toshiba’s boardroom showdown a couple of week’s back. You may also remember that we finished the section by saying:

“With the amount of dry powder waiting to be deployed by sponsors around the world, we could be in for a very interesting period for Japanese business”

Now, I want to say that when I said this, I really wasn’t expecting to be writing about fresh developments so soon, especially at the scale of what has transpired since.

So, what’s gone down?

After the historic win by activists at the firms Emergency General Meeting (EGM) last month, international private equity investors seem to have interpreted this shift in sentiment5 to mean:

“Hostile takeovers in Japan are now a go, but lets start with Toshiba”

The first to make a move was the European PE firm CVC Capital Partners (which was the previous employer of Nobuaki Kurumatani, Toshiba’s CEO). The buyout shop immediately offered the Toshiba board a takeover offer of $20bn, hoping to use their c-suite clout to get their offer across the line promptly. This prospect was quickly dismissed as Toshiba’s board pressured Kurumatani out of his position as head of the conglomerate last week. This move left the CVC deal in tatters but left the door open for others to approach Toshiba, which is where we are now.

We’re hearing rumours about other private equity investors6 are preparing to launch formal bids in excess of the first $20bn offer for the Toshiba business, which is exciting, but failing to interest shareholders, as the current share price is still 10% below the CVC offer. I expect there is widely held sentiment that even if there is an appropriately valued offer on the table, the board would reject any approach from an international buyout shop.

A really cool angle to look at this series of events through is the movements in Toshiba’s credit default swap (CDS). As many of you will know, a companies CDS is a proxy for the default risk, and gives everyone a somewhat decent look at how much more or less risky a company is perceived by the market. Here’s the graph of the past few months:

As you can see, after the EGM win, Toshiba’s implied default risk shot up 50%, before then coming back down to previous prices, before then rocketing 200% after the prospect of a $20bn LBO came into investor’s minds. Interestingly, its come down after the CEO left, perhaps adding weight to the idea that CVC’s approach was the most likely to actually complete, and any others wouldn’t be feasible.

As always, time will tell with this one.

Einhorn

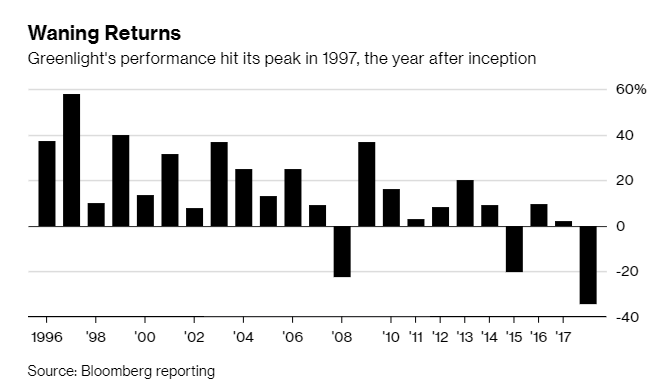

David Einhorn is one of those hedge fund managers that launched his fund in the late ’90s, spent the next decade notching up a spectacular track record, spotted the housing bubble, and hasn’t really done anything particularly impressive since7.

Einhorn is, in my opinion, one of the best and most logical value investors of our time. The only issue for him is that value just hasn’t performed since 20088. His strategy of buying companies that trade at large discounts to their intrinsic value, and shorting those that trade at massive premiums, has been absolutely hammered over the past decade.

As everyone is painfully aware, ‘growth’ stocks have consistently outperformed their ‘value’ peers since the financial crisis, and value experts like Einhorn have struggled to deal with that fact9.

So, the reason we’re talking about Einhorn today is a result of his fund, Greenlight Capital10, posting its Q1 Investor Letter this week (find it here). It covered some interesting stuff.

It initially highlighted the fact that it returned -0.1% in the first quarter, whilst the S&P 500 returned a whopping 6.2%, before quickly trying to reassure investors that:

“the investment environment – especially from mid-February through the end of the quarter – was favorable as value outperformed growth, and interest rates and inflation expectations rose”.

Which roughly translates to:

“Even though we’ve lost a lot of your money, the tides could be about to turn in our favour, so please don’t redeem your money”

He touched upon how irresponsible the Fed was being with its ‘markets focussed’ approach to stimulating the economy, as well as the silly stance their taking on inflation. But most importantly, he mentioned the GameStonk saga that occurred at the end of January, and reiterated a common sentiment:

Whilst debate is always useful, dragging Ken Griffin, Gabe Plotkin, Vlad Tenev and u/DeepF*ckingValue to congress was probably a little much.

Hedge funds should be allowed to make money if they have good ideas, and lose money if they have bad ideas.

Robinhood’s business model of selling order flow should be viewed as simply another form of commission. The fact that Citadel Securities, Virtu, SIG, and Jump all front-run your positions will make your spread less attractive.

Robinhood didn’t suspend trading because Plotkin was losing a lot of money, their business just wasn’t ready to get a $3bn overnight bill from their clearing house.

Elon Musk and Chamath Palihapitiya’s tweets and statements around GameStop were the jet fuel that stirred the masses. Whilst Elon is Elon, and we should know better than question whether he’s going to be told off for anything anymore, one could argue that Chamath purposefully pumped GME to destabilise Robinhood, which would benefit SoFi, one of his SPACs. This is clearly very naughty.

The best part about this letter though was Einhorn’s mention of Hometown International (HWIN). HWIN is a seemingly normal small-cap firm trading on OTC markets in the US with a market capitalisation of ~$100m, but the really funny thing is the fact that its only asset is a single deli, operating in rural New Jersey, generating only $13,976… in sales…11. The fact that these kind of public companies still exist amazes me.

Whilst hilarious, Einhorn’s of course trying to put emphasis on his point that modern markets are currently:

“fractured and possibly in the process of breaking completely.”

Which, I have to say, I completely agree with.

That’s it for today, onto the articles!

Give This A Read:

If you’ve been sitting at home over the weekend and seen a headline along the lines of ‘DogeCoin now worth more than Credit Suisse’, you may be wondering ‘What the hell is DogeCoin?’. In simple terms, DogeCoin is Bitcoin12, except with a different name, different ticker, and slightly different characteristics. It was set up as a joke in 2013 and has been beloved by the crypto community ever since. Read this to learn some more about the first meme-coin. This week, Doge rallied >300%, and at one point had a ‘market cap’ (# of Doge’s * Doge/USD price) of ~$55bn, which is actually double that of Credit Suisse’s. Nuts.

Let this price explosion serve as yet another reminder that the primary driver of alpha in modern markets is the mighty meme. Long live the stonk.

Here Are 5 Cool Finance-ey Articles That I Think You’ll Enjoy:

The Dominatrix Of Debt Has Her Way, Whether You Like It Or Not (WSJ)

Charles Schwab Takes A Leaf Out Of Citi’s Rulebook (DealBreaker)

A Hedge Fund Analyst Looks Back At The Past Few Years In US CMBS (Petition)

Bill Hwang Had Invested Into A Whole Host Of Other Tiger Cubs/Grandcubs (II)

Should We Be Worried By China’s ‘PBoC Coin’? (Alphaville)

Some Other Cool Stuff That Some Of You May Think Is Interesting:

Colin The Caterpillar Goes To War With Aldi’s Cuthbert The Caterpillar (FT)

A 4 Foot Rabbit Called Darius Remains A Smuggling Risk (Guardian)

Former CIA Director Voices His Support For Bitcoin And Crypto (Forbes)

Just A Really Cool Restored 1969 Porsche 911T (Fuel Tank)

The Coolest Website I’ve Ever Seen (Yamauchi No.10)

Well done for making it through all of that, and, as always, feel free to reach out if you fancy. Also, please feel free to share/forward this email far and wide, as the more the merrier!

On that note, stay safe, stay alert, and have a great week everyone!

AC

Full disclosure: I’m doing my dissertation on European NPLs at the moment, so I’m in the perilous position of being fascinated by what’s happening, and *think* that I understand what’s going on…

We’ve spoken about Chinese banks in the past, but for our new subscribers, know that the ‘big four’ state-owned Chinese banks are:

The Industrial and Commercial Bank of China (ICBC)

The China Construction Bank (CCB)

The Bank of China (BoC)

The Agricultural Bank of China. (ABC)

A portion of this growth has stemmed from the fact that Huarong has ventured into other financial offerings, like investment banking, trust management and real estate finance.

This push for diversification was predominantly led by Lai Xiaomin (know in inner circles as ‘the god of wealth’), the chairman between 2012 and 2018. Lai was seminal in bringing on new investors over his tenure and expanding the firm’s remit into even more risky areas of the Chinese economy.

He was also later found guilty of embezzling over $250m from Huarong and sentenced to death.

During the investigation, police discovered that Lai had (through Huarong’s real estate business) built an entire 120 suite apartment complex in Guangdong, with the sole purpose of housing his wife, his young family, and over 100 mistresses… Hilarious.

He also used another apartment in Beijing as a massive safe, that he called ‘the supermarket’. What was Lai keeping in ‘the supermarket’? This photo might give you a clue:

Yep, that’s all cash…

Dollar bonds issued by Chinese firms are called ‘Kung Fu Bonds’, which I think is amazing.

If you didn’t read my last post about Japan’s stance towards hostility, you may not know that Japan has been notoriously anti-activist for a long time. Corporate structures on the island are arranged in a way to make it very difficult for foreigners to come in and push for change, let alone launch a takeover bid.

This all changed a month ago, as a group of activists launched a campaign to look into voting irregularities in the previous AGM, which was successful, indicating that Japanese investors are willing to be somewhat flexible when it comes to activism.

KKR, Bain and Brookfield are the three making their intentions most apparent, but I’m sure there are more on their way.

Others, like our good friend Bill Ackman, found themselves in a similar position after the financial crisis, but most have managed to pivot and reverse their bad fortunes. (Not that I think Einhorn should follow suit, but) Ackman put his turn in fortune down to his new wife, Neri Oxman, who is an MIT professor and designer.

Apparently, this isn’t a reference to the ‘green light of hope’ of the Great Gatsby, which ruined my day when I found out.

As you can imagine, Twitter had a field day with this and took it upon themselves to make fun of Hometown International and its directors.

As a result of most cryptocurrencies being ‘open-source’ (which is another way of saying ‘free to blatantly copy’), Dogecoin is effectively a rebranded Litecoin, which itself is a rebranded Bitcoin. All of the technical backend shenanigans are mostly the same, but the popular ones have simply been marketed better than others…